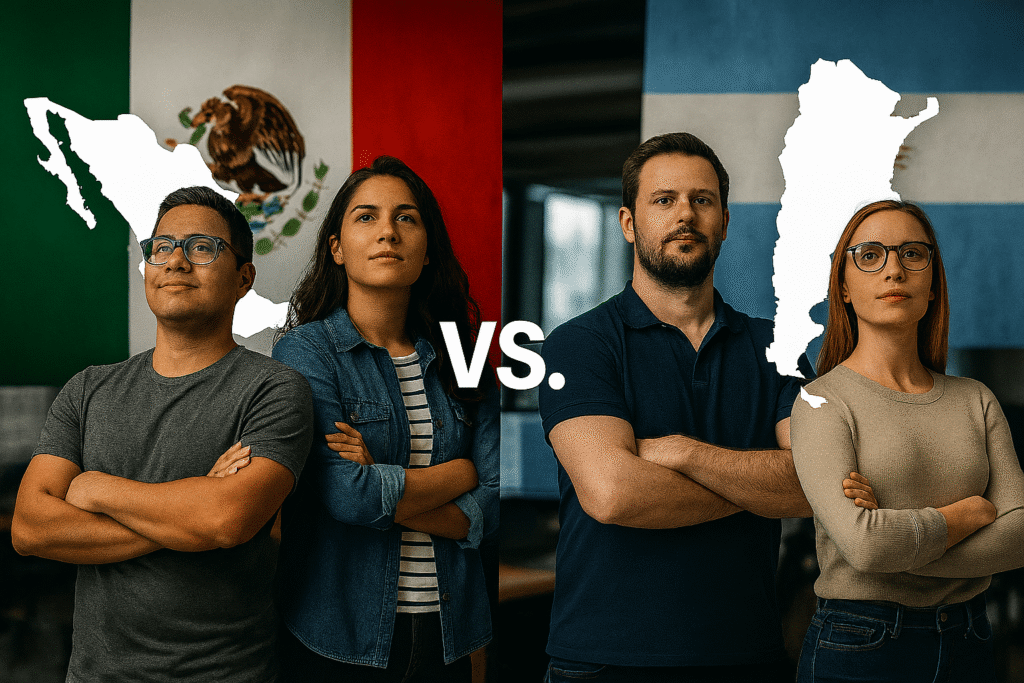

Argentina vs. Mexico for Nearshoring: A Brief Summary

Nearshoring isn’t just a trend — it’s the new competitive edge. As U.S. tech companies race to build high-performing teams without breaking the bank, Latin America has become the go-to talent hub. Among the top contenders, Argentina and Mexico stand out as nearshoring powerhouses, but for very different reasons. One offers world-class senior talent with top-notch English skills, while the other wins on sheer proximity and scale.

So, which country is the smarter choice for your tech team? Let’s break it down.

Table of Content

Why Nearshore to Latin America?

For U.S. tech companies, Latin America has become the go-to alternative to traditional offshoring hubs, and for good reason. Nearshoring to the region combines cost efficiency, high-quality talent, and operational convenience, offering a strategic advantage for companies looking to scale fast without compromising on standards.

Time Zone Alignment for Real-Time Collaboration

Unlike offshore destinations in Asia or Eastern Europe, where time differences can stretch to 8–12 hours, LATAM developers work in the same or adjacent time zones as most U.S. states. This means:

- Daily standups, sprint planning, and urgent troubleshooting can all happen in real time.

- Less reliance on asynchronous communication, which speeds up product iterations.

- No need for night shifts or “split teams” to maintain productivity.

Deep and Diverse Talent Pool

Latin America has invested heavily in tech education over the past decade, producing a consistent pipeline of skilled developers. For instance:

- Argentina is renowned for its highly educated senior engineers, many with advanced degrees in mathematics and computer science.

- Mexico boasts one of the largest tech workforces in the region, with a focus on full-stack development, cloud, and enterprise software.

Additionally, LATAM developers are accustomed to working with U.S. companies, meaning they are already familiar with agile practices and U.S.-style communication.

Cultural and Business Compatibility

The cultural gap between U.S. companies and LATAM teams is far smaller than with other offshore regions. Shared values around collaboration, accountability, and work pace make integration smoother. English proficiency is also steadily improving, especially in countries like Argentina (among the highest in LATAM) and urban centers in Mexico.

Cost-Effective Without Sacrificing Quality

While LATAM developers earn higher salaries than their Asian counterparts, they offer superior communication, better cultural fit, and faster productivity ramp-up times—factors that often offset any marginal cost difference. Compared to U.S. rates, the savings are still significant, with senior developers often costing 40–60% less.

Proximity and Travel Convenience

Face-to-face meetings, team-building sessions, or on-site training are far easier with LATAM teams. Flights from the U.S. to Mexico or Argentina take hours, not days, and require fewer logistical hurdles — something crucial for companies that value close-knit team culture.

Argentina for Nearshoring

Argentina has positioned itself as one of Latin America’s premier destinations for nearshoring tech talent — a mix of high-quality engineering expertise, strong English proficiency, and cost-effectiveness that appeals to U.S. tech companies looking to scale.

Top-Tier Talent Pool and World-Class Education

With over 160,000 software engineers, Argentina boasts one of the deepest and most skilled tech talent pools in Latin America. The country ranks #4 in the region for data science skills and is a recognized leader in software development specializations, including mobile development, data analytics, and cloud technologies.

This expertise is backed by a robust educational infrastructure: ten Argentine universities, including the University of Buenos Aires, are ranked among the world’s best for computer science and engineering. Such a strong academic foundation produces developers who can tackle complex, high-stakes projects from day one—making them particularly attractive for startups and scale-ups building cutting-edge products.

High English Proficiency and Seamless Communication

Argentina consistently ranks among the top Latin American countries for English fluency. According to the EF English Proficiency Index, it holds the #2 spot in the region and 28th globally.

For U.S. companies, this means Argentine developers can:

- Confidently participate in English-language meetings.

- Clearly articulate technical requirements and collaborate in real time via platforms like Slack or Zoom.

This eliminates one of the biggest pain points in offshoring—language barriers—and allows Argentine engineers to integrate into U.S.-based teams with minimal friction.

Time Zone Alignment with the U.S.

Operating in GMT-3, Buenos Aires is only one hour ahead of Eastern Time (depending on the season) and just a few hours apart from most other U.S. time zones.

This overlap enables:

- Same-day feedback loops for faster development cycles.

- Real-time troubleshooting and pair programming.

- Convenient scheduling of standups, sprint planning, and review meetings.

For fast-paced startups, this level of time zone alignment makes an Argentine team feel virtually next door.

Cost-Effective, High-Value Talent

While Argentina’s engineers deliver Silicon Valley-level expertise, their salaries remain highly competitive:

- A senior software engineer typically earns 50–55% less than an equivalent U.S.-based professional.

- Argentina also offers some of the lowest developer salaries in LATAM for this level of skill.

For tech companies, this translates into more hiring power and extended runway—you can add extra engineers or allocate more budget to R&D while maintaining quality.

Thriving Tech Ecosystem and Remote-Ready Culture

Argentina’s tech ecosystem is vibrant and future-ready:

- 3,800+ tech companies, 1,200+ startups, and 11 unicorns call Argentina home, including success stories like MercadoLibre, Globant, and Despegar.

- Ranked the 4th strongest startup ecosystem in Latin America, Argentina fosters a culture of innovation, agile development, and modern frameworks that mirror Silicon Valley standards.

For tech companies, this translates into more hiring power and extended runway—you can add extra engineers or allocate more budget to R&D while maintaining quality.

Argentina is also highly remote-work-friendly:

- The Teleworking Law provides a stable legal framework for distributed teams.

- Many developers have years of experience delivering projects for U.S. and European clients.

- Coworking hubs, tech parks, and community meetups in Buenos Aires (Palermo Valley) and Córdoba nurture continuous learning and collaboration.

This combination of strong infrastructure, experienced remote talent, and an innovation-driven mindset ensures that Argentine engineers integrate quickly and perform effectively in global teams.

Strategic Tech Hubs Across the Country

While Buenos Aires remains the epicenter of Argentina’s tech scene, other cities like Córdoba, Mendoza, and Rosario are rapidly expanding their tech communities. Supported by public-private initiatives such as CONICET and INSTITUTO Balseiro, these hubs are fueling research, innovation, and the steady supply of engineering talent.

Mexico for Nearshoring

Mexico has rapidly evolved into one of Latin America’s strongest tech nearshoring destinations, offering a vast engineering talent pool, U.S.-friendly proximity, and a thriving startup ecosystem. For U.S. tech companies, Mexico’s combination of scale, cost-effectiveness, and business compatibility makes it a strategic choice for building or expanding nearshore software development teams.

Vast Talent Pool and Solid Educational Foundation

Mexico is home to one of the largest engineering workforces in Latin America:

- 382,000 software developers and analysts, according to government estimates.

- 976,000 professionals trained in tech, according to the National Institute of Statistics and Geography.

This talent pool is continuously fueled by 1,200+ institutions offering computer science degrees, including top-ranked universities such as:

- Tecnológico de Monterrey (Monterrey, Nuevo León)

- Universidad Nacional Autónoma de México (Mexico City)

- Instituto Politécnico Nacional (Mexico City)

- Universidad de Guadalajara (Jalisco)

Graduates from these institutions enter the workforce with strong foundations in JavaScript, Java, Python, SQL, and C++, and are proficient in modern frameworks like React JS, Angular, Bootstrap, and ASP.Net Core. This breadth of technical skills makes Mexican engineers highly versatile, capable of handling full-stack, fintech, and enterprise-grade projects.

Thriving Fintech and Startup Ecosystem

Mexico’s tech ecosystem has seen exponential growth in recent years:

- The country hosts over 650 fintech startups, representing 20% of all venture investment in LATAM’s fintech industry.

- A new wave of tech-focused incubators, accelerators, and co-working spaces is driving innovation and helping early-stage companies scale.

This vibrant ecosystem means many Mexican developers already have hands-on experience building and maintaining fintech platforms and SaaS products, making them ideal hires for startups seeking fast-paced, product-driven expertise.

Key Tech Hubs Across the Country

Several cities stand out as Mexico’s primary tech hubs:

- Mexico City – The country’s largest tech hub, with a dynamic mix of startups, incubators, and tech events.

- Guadalajara – Dubbed the “Silicon Valley of Mexico,” it specializes in software development and tech services, supported by a strong university network.

- Monterrey – Traditionally known for its industrial base, Monterrey is rapidly expanding its tech startup and innovation ecosystem.

These cities are also home to major international tech players—IBM, Intel, and HP—who have established operations to tap into Mexico’s talent and strategic location.

Government Support and Policies Encouraging Tech Growth

Mexico’s government actively supports tech industry development through:

- Prosoft Program – Offering financial incentives, training programs, and resources for tech startups and established firms.

- Venture Capital Support – Public-private partnerships to increase VC funding for early-stage companies.

- Technology Parks and Innovation Hubs – Infrastructure that facilitates collaboration, research, and rapid scaling for tech companies.

These initiatives have created a business-friendly environment that encourages innovation and attracts foreign investment.

Proximity to the U.S. and Time Zone Alignment

One of Mexico’s biggest advantages is its geographic closeness to the U.S.:

- Minimal travel time for on-site visits and team-building activities.

- Similar time zones allows for real-time collaboration, daily standups, and faster issue resolution.

For U.S. companies, this alignment can significantly reduce project turnaround times and enable a level of integration that feels almost onshore.

Cultural Compatibility and English Proficiency

Mexican developers share similar work ethics, communication styles, and business practices with U.S. teams, making collaboration smooth. Many are also bilingual, with strong English proficiency, which eliminates communication barriers and ensures clarity in technical discussions, documentation, and agile ceremonies.

Cost-Effective, High-Quality Talent

Hiring in Mexico is significantly more affordable than in the U.S. while maintaining high quality. Companies benefit from:

- Competitive salaries (often 40–60% lower than U.S. equivalents).

- Lower operational expenses for office space, utilities, and infrastructure.

This cost efficiency allows startups to scale faster and maximize ROI without compromising on expertise.

Head-to-Head Comparison

Both Argentina and Mexico are top choices for nearshoring, but they shine in different ways. Here’s how they stack up across the most critical factors for U.S. tech companies:

| Criteria | Argentina | Mexico |

|---|---|---|

| Talent Pool Size | ~160,000 software engineers; highly specialized in data science, analytics, mobile & cloud | ~382,000 software developers & analysts, 976,000 trained in IT; great for full-stack & enterprise-scale projects |

| Education & Expertise | 10 top-ranked universities (e.g., University of Buenos Aires); strong math & computer science foundation; ranked #4 in LATAM for data science skills | 1,200+ tech institutions (e.g., Tecnológico de Monterrey, UNAM); strong focus on software engineering & fintech |

| English Proficiency | #2 in LATAM, 28th globally (EF EPI); excellent for seamless integration into English-speaking teams | Widespread bilingual workforce; good English proficiency in tech hubs, especially Mexico City & Guadalajara |

| Tech Ecosystem | 3,800+ tech companies, 1,200+ startups, 11 unicorns; strong culture of innovation & remote work | 650+ fintech startups; rapid growth of tech parks, accelerators, & co-working spaces; presence of IBM, Intel, HP |

| Specializations | Fintech, SaaS, AI, data analytics, cloud | Fintech, full-stack, enterprise solutions |

| Time Zone Alignment | GMT-3; ~1 hour ahead of U.S. Eastern Time; great for real-time collaboration | Same or near-same time zones as U.S.; excellent for daily standups & same-day feedback |

| Cost-Effectiveness | ~50–55% lower salaries than U.S.; among the lowest developer rates in LATAM | 40–60% lower salaries than U.S.; cost-effective for scaling larger teams |

| Cultural Compatibility | Strong Western work style, proactive problem-solving, highly remote-work experienced | Strong U.S. cultural alignment, business practices, and collaborative work ethic |

| Main Tech Hubs | Buenos Aires, Córdoba, Rosario, Mendoza | Mexico City, Guadalajara (“Silicon Valley of Mexico”), Monterrey |

| Best For | Specialized senior engineers; complex, high-stakes projects requiring strong English & advanced tech skills | Large-scale team builds; companies needing diverse skill sets & quick scaling |

Which One Should You Choose?

The answer depends entirely on your business priorities and growth stage, both Argentina and Mexico are excellent nearshoring options, but they serve different needs.

✅ Choose Argentina if:

You’re building a specialized, high-performance team where quality, expertise, and seamless integration into English-speaking workflows are top priorities. Argentina’s developers are ideal for fintech, SaaS, AI, and complex product development, where advanced technical skills and strong communication are critical.

✅ Choose Mexico if:

You need to scale fast, build larger teams, or launch projects that require a diverse mix of skills. Mexico’s vast talent pool, time zone parity with the U.S., and cost-effective rates make it perfect for companies seeking rapid team expansion and real-time collaboration.

The good news? You can’t go wrong with either choice — both countries offer world-class talent at a fraction of U.S. costs. The real key is to match the right talent strategy with your business goals.

If you’re not sure which market is the best fit, partnering with a staffing expert who knows both ecosystems inside out can help you make the smartest choice.

TurnKey Tech Staffing: Your Partner for Nearshoring in LATAM

Choosing between Argentina and Mexico for nearshore development doesn’t have to be a gamble, and that’s where TurnKey Tech Staffing comes in.

TurnKey specializes in helping U.S. tech companies build elite, custom-recruited offshore teams in Latin America. Whether you need senior Argentine engineers for complex fintech solutions or a large-scale development team in Mexico for rapid product rollout, TurnKey ensures you get the perfect talent match for your business goals.

Here’s why TurnKey is the go-to partner for nearshoring success:

- Custom Recruitment – Every role is sourced and vetted from scratch, ensuring you only hire developers who fit your exact tech stack and culture.

- Unmatched Retention – Our unique Talent Retention Program reduces developer churn by more than 50% compared to industry averages, keeping your team stable and productive for the long term.

- Transparent Pricing – With our cost-plus model, you always know exactly how much developers are paid, putting you in full control of compensation.

- Hassle-Free Employer of Record (EoR) – We handle all legal, tax, payroll, and compliance complexities, so you can focus entirely on building great products.

With proven experience in Argentina, Mexico, and other LATAM hot spots, TurnKey has helped dozens of fast-growing U.S. tech companies accelerate time to market while cutting hiring costs significantly.

If you’re ready to tap into Latin America’s best tech talent — without the headaches of traditional offshoring — TurnKey is your secret weapon.

FAQ

Argentina is generally the better choice for senior-level and specialized roles, particularly in fintech, SaaS, AI, and data analytics. The country’s developers have a strong academic background, rank among the top in LATAM countries for technical expertise, and have excellent English proficiency, making them ideal for complex, high-stakes projects.

Yes. Mexico has a significantly larger tech talent pool — 382,000 software developers and analysts — and a diverse range of skill sets. Combined with time zone alignment with the U.S. and cost-effectiveness, it’s perfect for companies looking to scale rapidly and build bigger teams for full-stack, enterprise, or fintech projects.

Both countries offer 40–60% cost savings compared to U.S. salaries. In Argentina, a senior software engineer typically earns 50–55% less than in the U.S., while Mexican salaries are slightly higher but still highly competitive. These savings allow companies to extend their runway, hire more talent, or invest more in product development without sacrificing quality.

TurnKey Staffing provides information for general guidance only and does not offer legal, tax, or accounting advice. We encourage you to consult with professional advisors before making any decision or taking any action that may affect your business or legal rights.

Tailor made solutions built around your needs

Get handpicked, hyper talented developers that are always a perfect fit.

Let’s talkPlease rate this article to help our team improve our content.

Here are recent articles about other exciting tech topics!